Chadwick Financial Management / Independent Financial Advisers

01803 834440 discover@chadfinman.com

Chadwick Financial Management / Independent Financial Advisers

01803 834440 discover@chadfinman.com

Many of our clients we have spoken with over the past few weeks have voiced their concerns over their savings and investments. With market volatility continuing, oil prices at record lows and most of the major global economies heading for recession and low cash returns, this comes as no surprise. We are, indeed, in unprecedented times.

Many of our clients we have spoken with over the past few weeks have voiced their concerns over their savings and investments. With market volatility continuing, oil prices at record lows and most of the major global economies heading for recession and low cash returns, this comes as no surprise. We are, indeed, in unprecedented times.So what can you do to protect your investments from there external forces in the short and long term?

Before we discuss possible courses of action it’s important to assess the situation we are faced with. Unlike previous financial crisis (.com bubble, 2008 banking crisis) the challenges the world financial institutions now face are very different. The fundamental reasons for recession, business closure and market volatility are unrelated to the financial world. If Covid-19 had not caused the global business slow down we have seen, there is no reason to suggest your finances wouldn’t have stayed in a similar position to how there were before.

Whilst this is a frustrating and worrying situation for many with money currently in investments, a historical look would suggest that maybe doing very little can be the best plan of action. Large financials downturns have historically been short with most followed by balancing gains in equally quick periods of time.

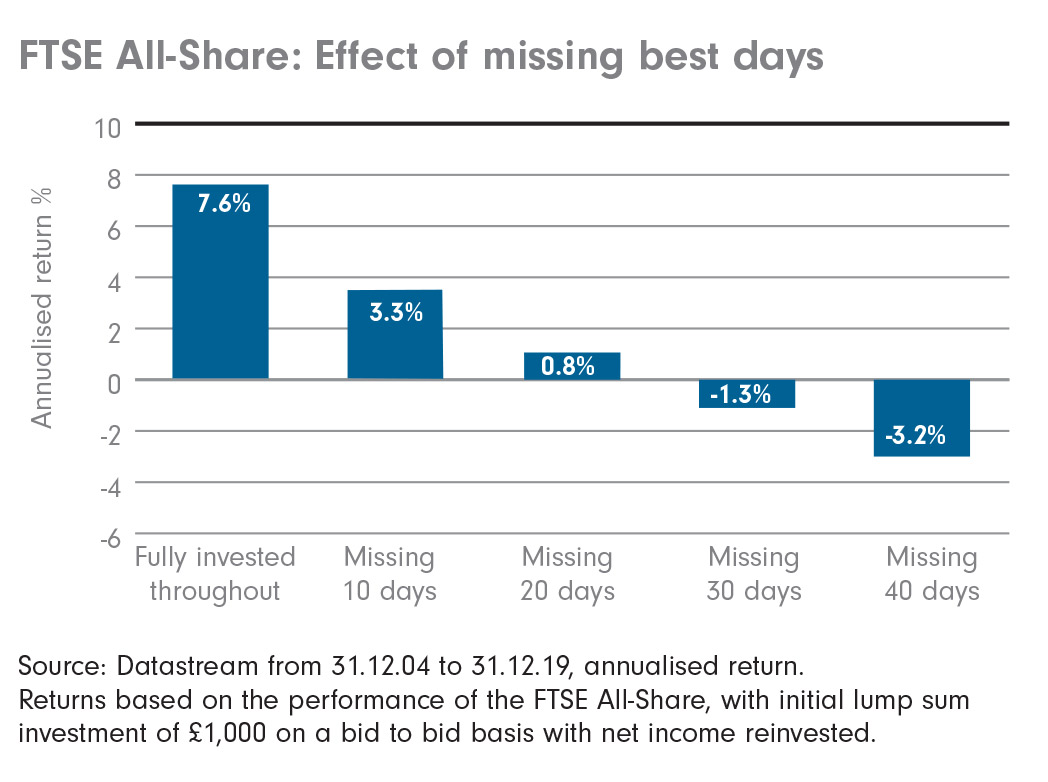

Fidelity International demonstrate this clearly with the below graph:

This graph averages the amount of investment growth over the past 15 years if investors had removed their money after a financial downturn. It would suggest sitting tight could be the best method to see out any financial crisis.

If you have invested in ‘high risk’ markets or shares then peaks and troughs are something you will be more used to than most, however, if you are looking to consolidate your investments on a more balanced and diversified footing, then there are many options from the whole market which Chadwicks can discuss with you.

One example of the many options is the PruFund which has been running for 15 years. Below is a video describing how their fund works and how their balanced approached has served thier clients.

If you’r still unsure as to what you should be doing then why not give Chadwicks a call on 0800 833 389 or email at discover@chadfinman.com. We cover the whole market and can offer trusted, impartial advice to help give you a balanced approach to make an informed decision on your finances.

Please note that past performance is not a reliable indicator of future returns. The value of investments can go down as well as up, so you may get back less than you invest.

* www.fidelityinternational.com